The circular economy where things are continually recycled is not a concept that you would especially associate with finance tech companies.

Yet London-based startup Diem has not only come up with a concept that combines banking and the circular economy it has scored $5.5 million in a seed funding round led by Fasanara Capital to develop it.

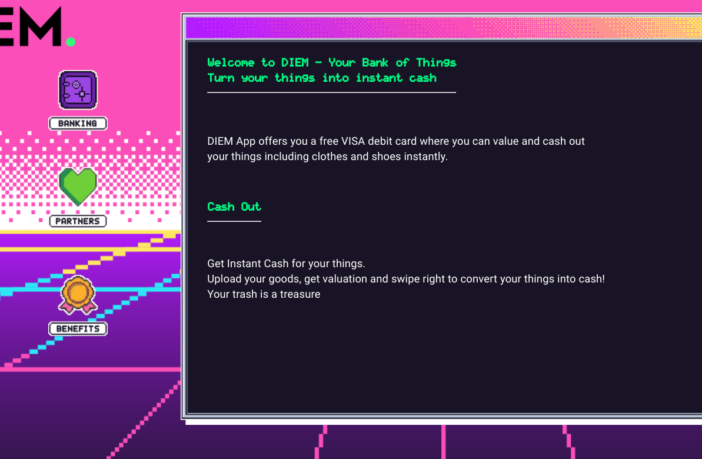

It sounds like a very smart idea. Diem offers its users the traditional account and money management tools, but the twist is a cash out feature where customers can get instant credit for items they don’t want anymore.

So rather than place the products on eBay, Facebook Marketplace Depop etc Diem users get an instant valuation and if they take it instinct cash.

You could think of Diem as a bit like a digital pawnbroker.

The smart bit for Diem is the algorithm that calculates the fee. It then uses the same technology to work out which channel is most likely to make the best resale fee for the product.

Buying and selling used products has been on the up for years now, and last year was boosted by the lockdown with consumers across the globe spending more time both shopping online and often clearing out unwanted items.

Diem majors on sustainability. On its website it says “DIEM is built on Circular Economy principles. Extending the life of clothes by just 9 months of use would reduce carbon, water and waste footprints by around 20-30% each.”

It is also seeking B-Corp status.

Geri Cupi, founder, Diem, says: “Diem’s mission is to empower consumers to value, unlock, and enjoy wealth they never knew they had. All of this while fuelling the circular economy and supporting the commitment to sustainability as our key value proposition. Diem makes it possible for capitalism and sustainability to co-exist.”

Annoyingly for the company, DIEM is also the name of Facebook’s recently renamed crypto project, so it will be interesting to see how both entities cohabit or come to an arrangement.